Page Contents

- Acorns App Review Summary

- What is Acorns App?

- How Does Acorns App Work?

- What’s Inside Acorns App?

- 1. Acorns Invest

- 2. Acorns Later

- 3. Acorns Spend

- 4. Acorns Found Money

- 4. Portfolios

- How Much Does Acorns Cost?

- 1. Acorns Invest - $1 per Month

- 2. Acorns Invest + Acorns Later - $2 per Month

- 3. Acorns Invest + Acorns Later + Acorns Spend - $3 per Month

- Who is Acorns Best Fit For?

- What I Like About Acorns App

- 1. You Can Start Investing With Just Any Amount Immediately

- 2. Acorns Securities LLC is a Well-Established Company

- 3. Automatic Saving Feature

- 4. Real Owners and Team

- What I Don’t Like

- 1. Expensive If Your Balance is Small

- Is Acorns App a Scam?

- Who Have Started Their Online Business

Welcome to my Acorns App Review!

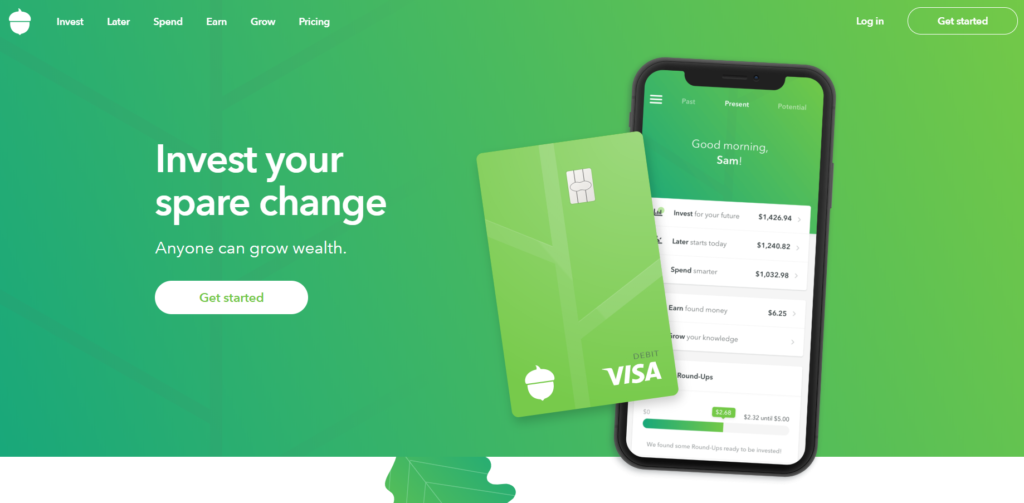

Have you heard about an investing app that will allow you to invest even the smallest spare change you have? That’s Acorns App and we will be talking about this micro-investment app today!

You see, most of us become scared when we hear the word “investment” because we are thinking that it will require lots of money from us. But, Acorns App has changed that with their “spare change” investment process.

You wouldn’t even notice that you are already setting aside some money to invest in the firm and then you are making profits from it.

How does that sound like?

It’s really very interesting, right?

Furthermore, to get all the important information about Acorns App, I did some research about it and came up with this review.

Is Acorns App a scam? Or is it a legit micro-trading platform to trust your spare change with?

Find out the answers in this Acorns App review!

But before that, why don’t you stop wasting your time on scams and start a legit online business with my no. 1 recommended product? No unrealistic promises, no “get-rich-quick” scheme, just purely affiliate marketing at work.

Acorns App Review Summary

Name: Acorns

Website: https://www.acorns.com/

Founders: Walter and Jeff Cruttenden

Launched Date: August 26, 2014

Type: Micro-Investment Trading

Price: $1 – $3 Monthly Fees

Eligibility: US Residents Only

Scam/Legit: Legit

Summary: The Acorns App lets you invest your extra change right after shopping. It is a fully-automated app that will help turn your spare change into a profit-generating investment. And, using the app is easy. You just need to set up your account, add relevant data, link your bank account, and then the app will take care of your money for you. Although Acorns App has good things to offer, there are still downsides to this software which we will discuss further later on.

Recommended: Yes

What is Acorns App?

The Acorns App is a software by the company Acorns which is designed to help people build their savings by following through the micro-investing process.

Additionally, the business under the name Acorns Securities LLC is founded by Walter and Jeff Cruttenden and was launched last August 26 in the year 2014.

You can see on their sales page that the company is committed and focused more on giving every people the chance to invest, and investing it even more easily. They also stated that they aim to “look after the financial best interests of the up-and-coming beginning with the empowering step in micro-investing.”

So, yep, Acorns is leveraging its business operations in micro-investing.

Acorns has already made a name in the business therefore a lot of world-class investors, board members, advisors, and Nobel Prize economists have backed the business up.

With that in mind, you can assume that Acorns is a good business to trust, right? And a few coins won’t hurt so you can always trust apps like the Acorns App.

But, you need to be cautious because there might still be downsides to their process. Let’s look at how it works below.

How Does Acorns App Work?

I have already run you through what Acorns App is and some company background so now let’s talk about how it works.

Well, the process of investing using the Acorns App is simple. What you need to do first is to create an account, provide some details about yourself, link your bank account, and then start investing your shopping or any expense changes.

Additionally, it will only take you about 5 minutes to create your account. After that, you will be able to start adding money to your preferred method and a variety of portfolio that Acorns created for you.

To put simply, Acorns App encourages you to use a system that they call “round-ups” to invest your spare change. Acorns then monitors your bank account and invests the change from your daily purchases automatically.

Moreover, when it comes to withdrawing your money, you can do it anytime through electronic deposit into your checking account.

What’s Inside Acorns App?

Investing in Acorns, you will need to learn the following features that they have:

1. Acorns Invest

There are two methods of investing in Acorns and one is Acorns Invest. Acorns Invest is the micro-investing feature of Acorns that uses your spare change to invest automatically. This is mostly the method that you will encounter when you use Acorns App if you want to start investing for today.

2. Acorns Later

On the other hand, if you wanted to invest for retirement, the Acorns Later is available for you to use. Additionally, you need to set-up your own Acorns Individual Retirement Account to be used with Acorns Later.

3. Acorns Spend

Now the Acorns Spend works like a checking account which can also be used to automatically round up your purchases and start investing. They actually sold over 100,000 Acorns Spend with tungsten cards just days after it was launched.

Additionally, it includes a lot of benefits such as digital direct deposits, mobile check deposits and sending, free bank to bank transfers and more.

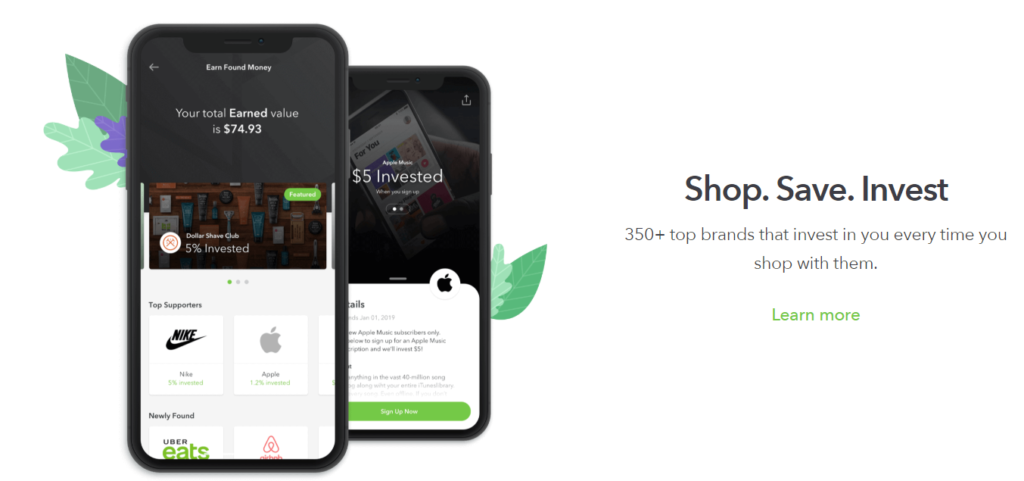

4. Acorns Found Money

Another feature of Acorns is the Acorns Found Money which allows other brands to invest in you. This investment happens whenever you purchase with a Found Money partner where your partner will then be able to invest in you.

‘You can picture this out working like a cashback process that will totally increase your investments.

4. Portfolios

In terms of the portfolios, there are a lot of them inside Acorns. These are as follows:

- Conservative

Short Term Government Bonds – 40%

Ultra Short Term Corporate Bonds – 40%

Ultra Short Term Government Bonds – 20

2. Moderately Conservative

Large Co. Stocks – 24%

Small Company Stocks – 4%

Real Estate Stocks – 4%

Government Bonds – 30%

Corporate Bonds – 30%

International Large Co. Stocks – 8%

3. Moderate

Large Co. Stocks – 29%

Small Company Stocks – 10%

Emerging Market Stocks – 3%

Real Estate Stocks – 6%

Government Bonds – 20%

Corporate Bonds – 20%

International Large Co. Stocks – 12%

4. Moderately Aggressive

Large Co. Stocks – 38%

Small Company Stocks – 14%

Emerging Market Stocks – 4%

Real Estate Stocks – 8%

Government Bonds – 10%

Corporate Bonds – 10%

International Large Co. Stocks – 16%

5. Aggressive

Large Co. Stocks – 40%

Small Company Stocks – 20%

Emerging Market Stocks – 10%

Real Estate Stocks – 10%

International Large Co. Stocks – 20%

How Much Does Acorns Cost?

Acorns is known to provide you with automatic daily, weekly and monthly investments at a low cost. Below are the fees per account:

1. Acorns Invest - $1 per Month

This includes the Acorns Invest ofcourse and the investment application.

2. Acorns Invest + Acorns Later - $2 per Month

With just $2 per month, you will now have the Acorns Invest, Acorns Later and the Acorns App.

3. Acorns Invest + Acorns Later + Acorns Spend - $3 per Month

At a low cost of $3, you will already enjoy the Acorns Invest, Later and Spend plus the Acorns App.

Who is Acorns Best Fit For?

In my opinion, Acorns App can benefit everybody but it’s open for US Residents only.

Additionally, I find Acorns App to be very convenient to use and helpful in terms of investing. They do not require large amount of money for you to start; only the spare change you have right after you shop.

Therefore, Acorns App gives us a great way to start investing and earning profits out of it.

Moreover, there are more ways to earn good cash online. If you want to learn how to build your own online business while investing, then you can check out my top recommended product. This product has taught me legit ways to make money online and enabled me to earn more than I could ever ask for.

What I Like About Acorns App

These are the things that I like about Acorns App or Acorns:

1. You Can Start Investing With Just Any Amount Immediately

I really like the fact that Acorns does not have any minimum amount of investment required in order for you to start. So you can just start investing with just any amount you want.

2. Acorns Securities LLC is a Well-Established Company

With more than 2 decades of operation in the business, you can rest assured that the company behind Acorns App knows what they’re doing.

3. Automatic Saving Feature

With the Acorns App, you can be able to set up your preferred amount of money to save automatically whenever your funds are available. This is a great way to help people who always find it hard to save and invest their money.

4. Real Owners and Team

On their sales page, you will find real people with real information. I really like it when you know the people behind the product or company that you are dealing with.

What I Don’t Like

Although Acorns looked so good, there are still things we should think about:

1. Expensive If Your Balance is Small

One thing that you need to consider when investing in Acorn is its rate. If you are not willing to invest a greater amount of money, you might find the $1 per month fee expensive when thought as a percentage to your investment amount.

Is Acorns App a Scam?

No, Acorns App is definitely not a scam. It’s a software backed up by a legit business and even a lot more legit shareholders. There is no doubt when it comes to it’s legitimacy, hence I can even recommend it.

However, you need to keep in mind that there might be disadvantages like their percentage fee if you invest small amounts. But all in all, the Acorns App is good and convenient to use.

Tired of scams? Check out my top recommended product now and start building your online business for free.

Join This Community Online

Who Have Started Their Online Business

Allysa Jane

Allysa is a passionate article/content writer with proven efficiency, quality, creativity, and uniqueness. She recently joined Internet Scams Report as a writer.